▸ Gifts of Stock ▸ The Waterstone Giving Fund

Gifts of Stock

DTC Transfer — If you have your shares of stock in a brokerage account this is a convenient way to transfer your securities. Simply instruct your broker to electronically transfer your securities out of your account into Growthtrac Ministries’ TD Ameritrade account and provide the appropriate account information below:

TD Ameritrade

FBO: Growthtrac Ministries

DTC#: 0188

Account#: 864703723

Notify Growthtrac Ministries: Click here to view and download our Appreciated Securities Transfer Form.

Certificate Transfer — Transferring your certificate can be as easy as endorsing the back of the certificate and sending it by certified mail to Growthtrac Ministries. You must sign the certificate in front of a bank officer to obtain a Medallion Signature Guarantee (notary public stamps are not an acceptable guarantor for stock certificates). Endorse the certificate exactly as your name(s) appears on the front. For example, if your certificate is listed as “John F. and Mary P. Jones,” you will need to sign the certificate exactly as “John F. Jones” and “Mary P. Jones.” Next, write Growthtrac Ministries’ tax identification number, 87-0732242, in the box on the back requesting a social security number or other identifying number of assignee. Mail the certificate by certified mail to:

Employee Owned Stock in Non-Retirement Plans — If you purchased stock from your employer (e.g. non-retirement E.S.O.P.) you can instruct them to issue a certificate in Growthtrac Ministries’ name. They will need our tax identification number, and our address as mentioned above.

The Waterstone Giving Fund

WaterStone is a Christian foundation that comes alongside givers and their advisors to provide trusted counsel and innovative giving strategies.

See Marriagetrac’s Waterstone information page | you may need a Waterstone account to view.

WaterStone’s expertise is working with business owners and stewards of family wealth to make their giving intentional and unlock the giving potential of their non — cash assets like real estate, business interests, oil & gas and agricultural commodities. Through WaterStone, families can multiply their giving impact for the Kingdom, minimize taxes and heighten the joy of generosity.

Current Giving

Cash typically represents less than 10% of a household’s wealth profile, but is the source for 80% of all charitable contributions. The bulk of a household’s wealth is found in non-cash assets (valuable holdings like real estate, closely-held businesses, and oil and gas and agricultural interests). By tapping into these assets, you can unlock your giving potential and multiply your giving impact on those churches, ministries, and charities about which you are passionate.

Cash gifts usually are solicited by nonprofits as:

- First time gifts

- Recurring or partnership gifts

- Annual fund gifts

- Capital campaign gifts

- Major gifts

Planned Giving

Many nonprofits also place an emphasis on planned giving as part of their fundraising efforts. When speaking to supporters about planned giving, nonprofits are usually asking for their nonprofit to be included in the distribution of the donor’s estate assets after death. Planned giving includes vehicles like:

- Trusts

- Charitable Remainder Trusts

- Bequests

- Titling of accounts

Planned giving also includes what we call intentional giving, the use of non-cash assets to fund present giving

Complex Gifts

WaterStone partners with ministries to unlock the giving potential of their donors that lies in their valuable non-cash assets like:

- Securities

- Real estate

- Business interests

- Agricultural commodities

- Oil & gas interests

WaterStone helps donors give more now by multiplying their giving impact, minimizing taxes and heightening their joy of generosity.

If you have questions, please contact WaterStone’s Director of Giving Strategies, Will Stevens, at wills@waterstone.org or by calling 719-447-4620.

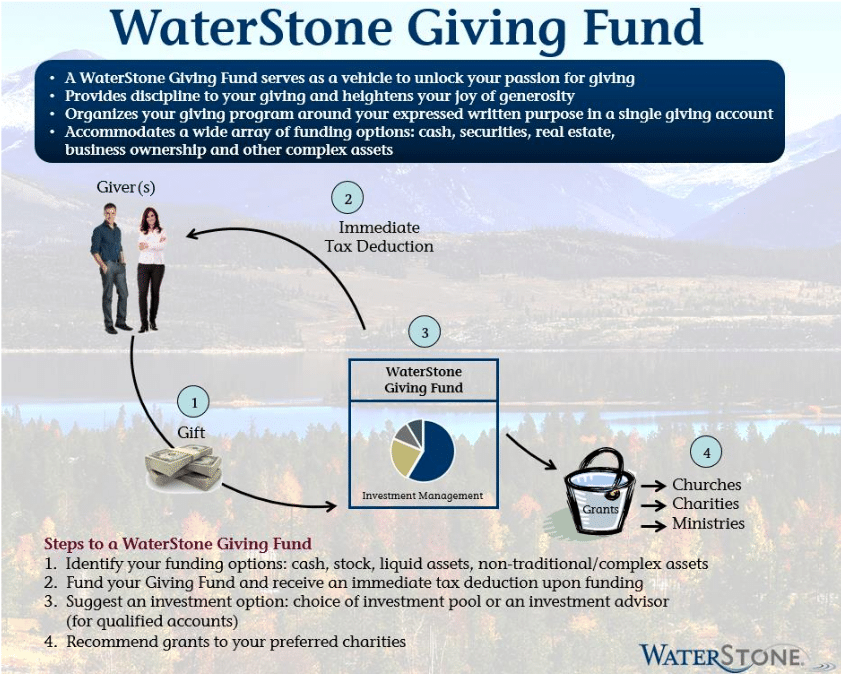

WaterStone Giving Fund

The Giving Fund is a flexible gifting solution through which you may devote a portion of your wealth for the support of your preferred ministries and nonprofits, receive an immediate tax deduction, and make grants at a later date.

A Giving Fund is just what the name implies. Your initial advice to the fund is given to WaterStone via the application, which advises to whom, how much and when to give from the fund. You may revise your fund purpose by adding or deleting ministries or charities, saving you the time and expense of changing wills, trusts or other legal documents.

For the individual families and corporations with the heartfelt desire to significantly influence your community during your lifetime, a Giving Fund is an outstanding option. WaterStone can help you transform your assets into living water. Not only will your contributions facilitate your current tax planning, but you will experience—in a greater way—God’s joy in charitable giving. With additional testamentary funding by will, charitable trust, gift annuity, retirement plan or insurance policy, you and your family can leave your own personal stamp on history.

Tax-savvy Giving with a WaterStone Giving Fund

- Immediate tax deduction when you add to your Giving Fund regardless of when distributed

- Greater deduction (up to 50% of AGI) than through a private foundation

- Giving Fund can receive appreciated complex assets: real estate, business interests, commodities, etc.

Simplicity of the WaterStone Giving Fund

- A single account for all your charitable gifting

- Recommend grants on your own timeline; grants can be requested online or by phone

- A single consolidated tax receipt for all your charitable contributions

Growthtrac Ministries partners with WaterStone to help you establish a Giving Fund Download our eBook, Faith and Finance for more information on Giving Funds at WaterStone.

For more information on Giving Funds at WaterStone. Please contact WaterStone’s Director of Giving Strategies, Will Stevens, at wills@waterstone.org or 719-447-4620 for more information on Giving Funds.

Disclaimer: The information contained on this page is not intended as a substitute for wise tax counsel. We strongly recommend you consult with a professional tax advisor before making a gift.Growthtrac Ministries is a 501(c) (3) organization and all gifts are tax deductible as allowed by law. We take very seriously the trust you place in Marriagetrac when you send a gift. We stand accountable before you and God to honor that trust. It is not our intention that the urgency of any communication from Marriagetrac cause feelings of pressure or obligation for financial support. You are invited to give only as you feel led to do so. Marriagetrac is supported by voluntary donations and grants. The bulk of Marriagetrac’s contributions are received from individuals. Donations to Marriagetrac are tax deductible.